The Volume Of Forex Strategy

- Posted in:Admin

- 03.10.18

- 93

• Increasing volume shows the conviction of buyers and sellers in either pushing the price up or down respectively. For example, if heads up and volume increases as the price moves higher, it shows buyers have an eagerness to buy and this typically happens with larger moves to the upside. • A trend can persist on declining volume for long periods of time, but typically declining volume as the price trends indicates the trend is weakening.

Binary Options Signal Services 383 views this week Whether a novice or experienced trader you will probably question how to find the best trading opportunities and enhance your profit potential. Well, in order to engage in the best trades, you should make use of signals software. Binary Options Signals are provided to traders to notify them when a new trading opportunity is available. My signals are extremely easy to follow and only require the trader to check a few points: asset, execution time, direction and expiry time. Binary options signals are online.

Automated forex trading software scans the market for favorable trades based on your input. Find out more about this valuable forex tool. What's the best automated Forex trading software? This is a discussion on What's the best automated Forex trading software? Within the Trading Systems forums, part of the Methods category; I found something called Shark 7.0 but I'm wondering if anyone here has experience with a similar automated program.  Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions. Any data and information is provided 'as is' solely for informational purposes, and is not intended for trading purposes or advice. The following is a comprehensive list of automated Forex trading brokers. You can rest assured that the automated Forex trading reviews listed below were conducted with the utmost level of professionalism and objectivity. Find out which is the best automated Forex trading software for professional traders, as well as, how to use it, the advantages of using it, and much more! We use cookies to give you the best possible experience on our website.

Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions. Any data and information is provided 'as is' solely for informational purposes, and is not intended for trading purposes or advice. The following is a comprehensive list of automated Forex trading brokers. You can rest assured that the automated Forex trading reviews listed below were conducted with the utmost level of professionalism and objectivity. Find out which is the best automated Forex trading software for professional traders, as well as, how to use it, the advantages of using it, and much more! We use cookies to give you the best possible experience on our website.

Risk Warning: Your capital is at risk. Forex exit from the castleton. Statistically, only 11-25% of traders gain profit when trading Forex and CFDs. The remaining 74-89% of customers lose their investment. 1# Parabolic and Volume Trading System Submit by ForexStrategiesresources The Parabolic Time/Price System is another idea that Welles Wilder introduced in his book New Concepts in Technical Trading Systems.

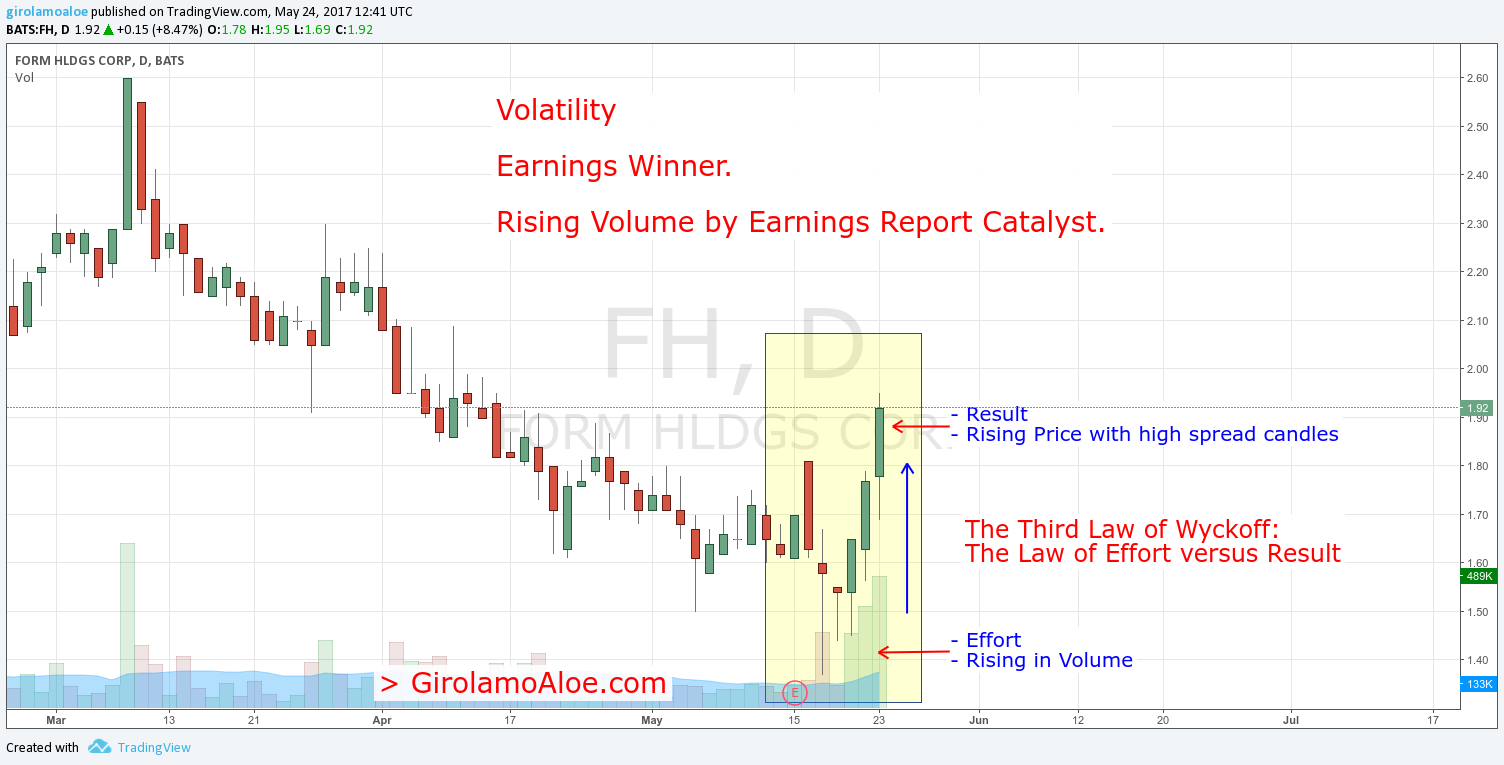

For example, if the trend heads up but volume steadily declines, it shows fewer people want to buy and keep pushing the price up. That said, the trend won't change until more large-scale selling volume than buying volume takes place. • Volume should ideally be larger when the price moves in the trending direction, and lower when moving against the trend, called pullbacks. This shows strong movement in the trend direction and weak pullbacks, making the trend more likely to continue. • High volume accompanied by sharp price movements against the trend signifies the trend is weakening, and/or susceptible to a reversal. • An extreme volume spike where volume trends up way more than normal, like 5 to 10 times or more than average volume for that time or period, for example, could indicate the end of a trend. These are termed exhaustion moves because typically, when so many shares change hands no one remains to keep pushing the price in the trending direction and it reverses, often quickly.

Forex Volume Strategy

In today’s article I want to spend a little bit of time explaining how we can use volume to get a better understanding of what’s going on in the market. The beginning of the asian session forex. Many traders dismiss volume as not being reliable and to some extent this belief is true. The volume we see on our charts is not the true actual volume, it’s the tick volume from the brokers platform. Tick volume is where 1 tick equals 1 trade, this means if you see a large volume spike in the market its telling you that a lot of traders either placed trades during the that time period or they closed trades. The true amount of volume cannot be known in the market because of how many different exchanges there are all over the world in which trading takes place on, when people realize this they tend to shy away from understanding volume and the information it reveals, which is unfortunate because knowing what the volume readings mean can aid you greatly in your trading and understanding of the market.