The Minimum Rate On Forex

- Posted in:Admin

- 06.10.18

- 47

german robot binary options Day traders shouldn't risk more than on a single trade. If your forex day trading account is $1,000, then the most you'll want to risk on a trade is $10. If your account is $10,000, risk $100 per trade.

Binary signals auto trading. Even great traders have strings of losses; by keeping the risk on each trade small, even a losing streak won't significantly deplete capital. Risk is determined by the difference between your entry price and the price of your, multiplied by the and the pip value (discussed in the scenarios below). Forex pairs trade in 1000, 10,000 and 100,000 units, called micro, mini and standard lots. Binary options brokers in canada. When starting out in forex day trading it's recommended traders open a micro lot account.

The Minimum Rate On Forex 2017

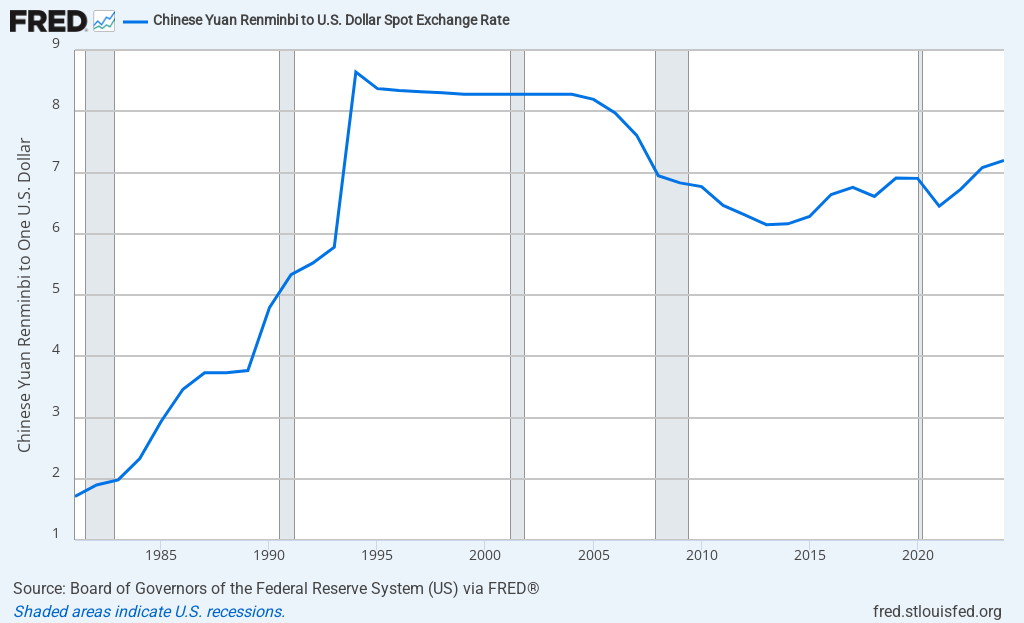

When you make a forex trade, you are buying and selling currency and, in essence, betting on the fluctuations in their exchange rates. For example, if you were to buy Euros when the conversion rate is 1.25 U.S. Dollars for 1 Euro then sell when the conversion rate is 1.28 U.S. Dollars to 1 Euro, that difference of.03 represents your profit. A 50% win rate with 1: 2 is a good stay in market. Any thing higher in winner percentage than 50% is a very good percentage. But its not easy to get a 1: 2 reward in your every wining trade so a bit higher winning percentage is enough to keep you towards earning side. Morocco's yearly minimum wage is $2,696.00 in International Currency. International Currency is a measure of currency based on the value of the United States dollar in 2009. International Currency is a measure of currency based on the value of the United States dollar in 2009.

Trading micro lots allows for more flexibility so risk remains below 1% of the account on each trade. For example, a micro-lot trader can buy $6,000 worth of currency, or $14,000, or $238,000 but if they open a mini lot account they can only trade in increments of $10,000, so $10,000, $20,000, etc. If trading standard lots, a trader can only take positions of $100,000, $200,000, etc. If you place a trade in the, buying or selling one micro lot, your stop loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss order is 11 pips away, your risk is 11 x $0.10 = $1.10, which is more risk than you're allowed.

Therefore, opening an account with $100 severely limits how you can trade and is not recommended. Also, if you are risking a very small dollar amount on each trade, by extension you aren't going to make very much money. Depositing $100 and hoping to draw an income just isn't going to happen.

The Swiss National Bank shocked global financial markets today as it abandoned is minimum exchange rate against the Euro which it introduced in September of 2011. This limit put a floor under the EURCHF at 1.2000 and the SNB has defended this level ever since then. This move was completely unexpected and no economists had forecasted the SNB to take this drastic measure.

Binary options trading demo. Swiss equity markets plunged as the Swiss Franc sky-rocketed. On January 5th 2015 SNB President Thomas Jordan ensured financial markets that the ceiling will remain in place and referred to it as ‘absolutely central’. This was followed by comments from Vice President Jean-Pierre Danthine on January 13th 2015 that the tool to defend the 1.2000 exchange rate against the Euro would remain a ‘pillar’ of the monetary policy enforced by the SNB. Forex traders had no reason to believe that the two most senior members of the SNB would mislead financial markets. The issues out of Ukraine as well as talks about a bond buying program out of the European Central Bank have caused more and more capital to flow to Switzerland.