Schedule Of Oil Prices On Forex

- Posted in:Admin

- 07.10.18

- 41

Oil is the commodity par excellence. Due to its high industrial and geo-strategic value, its current and future price is very sensitive to news or rumors that may affect supply and demand. The 14 nations who are members of OPEC accounted in 2015 for 43% of the world’s oil production, as well as holding 73% of global “proven” oil reserves. This means that OPEC has a significant impact on the prices of oil around the globe. **TAS orders executed during the trading session will be priced against the Settlement prices calculated and published on these days by ICE for ICE WTI, Heating Oil and RBOB Gasoline** ICE White Sugar Designated settlement period 16:53-16:55 UK (11:53 – 11:55 ET).

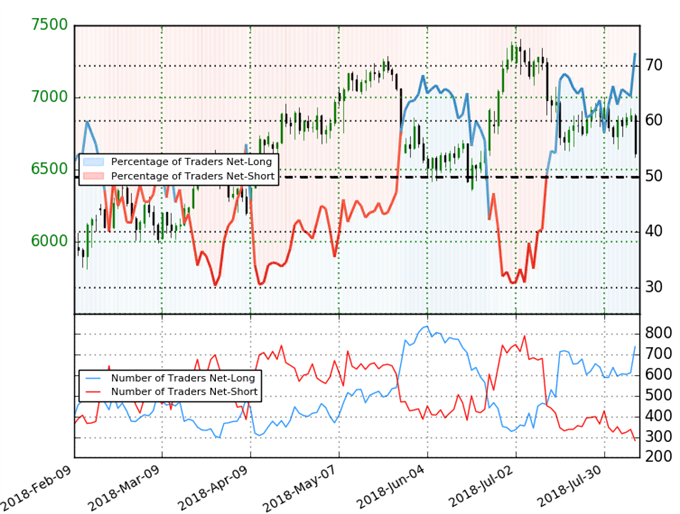

Full OPEC Meeting Schedule for 2018 When participating in trading on the financial markets, it is always important to keep an eye on the economic calendars so that you are aware of important upcoming news releases and key events occurring in the financial world. Binary options demo account 60 seconds. An awareness of the scheduling of high-impact data releases means that a trader can plan their trades accordingly, to either avoid the risk of investing at such a volatile time, or to benefit from the rapid movements in asset prices that occur around these events. One of the most important dates to be aware of in the economic calendar is the timing of the OPEC meeting, as the outcome of this meeting will have a significant impact on market prices, and especially that of global oil.

What is OPEC? OPEC is short for the Organisation of Petroleum Exporting Countries, which is a permanent organisation, designed to be intergovernmental, formed at the 1960 Baghdad Conference by the nations of Venezuela, Saudi Arabia, Kuwait, Iraq and Iran. These five founding countries were later joined by another nine member countries: Qatar in 1961, Indonesia in 1962, Libya in 1962, United Arab Emirates in 1967, Algeria in 1969, Nigeria in 1971, Ecuador in 1973, Angola in 2007 and Gabon in 1975. While some of these states have on occasion temporarily suspended their membership of the organisation, they are all currently participating members of OPEC. The headquarters of OPEC were originally located in Geneva in Switzerland; however after 5 years, they were relocated to Vienna, Austria. The purpose of OPEC is to unify and coordinate the policies pertaining to petroleum amongst its member countries, with the aim of securing stable and fair pricing on behalf of producers of petroleum, as well as ensuring a regular, economic and efficient petroleum supply to consuming nations, and guaranteeing fair returns on capital to anyone investing in the petroleum industry. The 14 nations who are members of OPEC accounted in 2015 for 43% of the world’s oil production, as well as holding 73% of global “proven” oil reserves.

This means that OPEC has a significant impact on the prices of oil around the globe. Over the last decade, the world economy has represented a major risk to oil markets because of macroeconomic uncertainties and heightened risk about international financial systems.

Binary options brokers will generally have their trading platform open when the market of the underlying asset is open. So if trading the NYSE, Nasdaq, DOW or S&P, the assets will be open to trade during the same hours as those markets are open. How binary options brokers make money. A binary option, sometimes called a digital option, is a type of option in which the trader takes a yes or no position on the price of a stock or other asset, such as ETFs or currencies, and the resulting payoff is all or nothing. Binary options provide a way to trade markets with capped risk and capped profit potential, based on a 'yes' or 'no' proposition. For example: Will the price of gold be above $1,250 at 1:30 p.m. A Google search for binary option Web sites produced 870,000 hits with promotions like 'earn up to 75 per cent every hour' and '81 per cent profit in one hour or less, trade all major markets'.