How Much Is 1 Lot Forex Chart

- Posted in:Admin

- 17.10.18

- 47

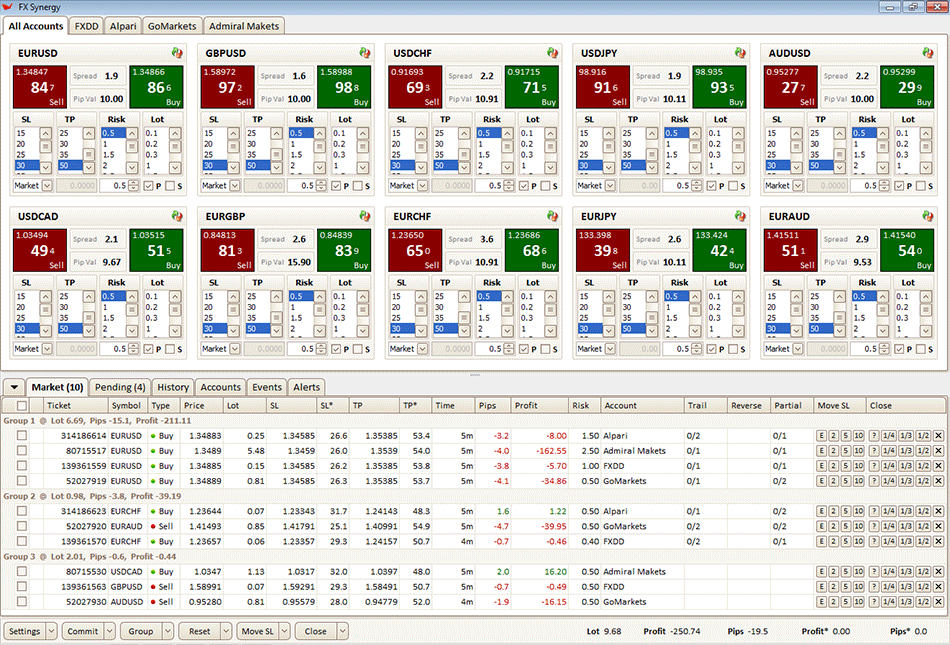

Sep 18, 2017 How much is that in dollars, just like it was in plus500, they converted the lot sizes into a visable amount of x dollars, this is how much 1000 units will cost you in order to open this trade. So that is my question. 1st Account: balance $500, min lot size 0.1 lot. 2nd Account: balance $500, min lot size 0.01 lot. In a typical trading situation, there are four consecutive losses of 50 pips each + 8 pips spread (2 pips for each trade) = 208 pips loss.

Forex Lots Explained

If you have a 10 pip stop loss and want to risk 2% on EURUSD (eurusd pip value for 1 lot is 10 dollars, different on different pairs) you enter a position of 0.4 lots. The underlying reason as to why lower time frames (I consider anything under a 1 hour chart to be a “low time frame”) have more failed signals than their higher time frame counter parts, is because there will be a lot more meaningless price movement on a 5 minute chart than on a 1 hour.

Binary options for stocks. A Google search for binary option Web sites produced 870,000 hits with promotions like 'earn up to 75 per cent every hour' and '81 per cent profit in one hour or less, trade all major markets'.

IgnoredC'mon man, it depends on the size of the trade. If I'm shorting cable with half a lot, at 3PM at some day, with a leverage of 200:1, value per pip could be x amount of my base currency, (we'll call it $26.7 AUD) I long the same pair, five days later but now with a standard lot and a leverage of 400:1, value per pip could be the same or it could be 36. The geometry of the forex market. 1, or 17.1, who knows. I just don't get it why you think value per pip is some sort of a standard price that can be applied anywhere? If I feel like I wanna long 0.38 lots of a pair, I don't need to get the calculator out to find out how much a pip I'm gonna make or lose, I can guess it roughly and I don't understand the significance behind the whole issue to be honest.

IgnoredC'mon man, it depends on the size of the trade. If I'm shorting cable with half a lot, at 3PM at some day, with a leverage of 200:1, value per pip could be x amount of my base currency, (we'll call it $26.7 AUD) I long the same pair, five days later but now with a standard lot and a leverage of 400:1, value per pip could be the same or it could be 36. The geometry of the forex market. 1, or 17.1, who knows. I just don't get it why you think value per pip is some sort of a standard price that can be applied anywhere? If I feel like I wanna long 0.38 lots of a pair, I don't need to get the calculator out to find out how much a pip I'm gonna make or lose, I can guess it roughly and I don't understand the significance behind the whole issue to be honest.

I have a game plan for 40-60 pip movements. I try to maintain a 2000-5000% margin level as well. On days i expect some serious movements i have pending trades for a 100 pip range. Forex strategy a win-win strategy.

Ignoredwhat does leverage have to do with it? Value per pip depends on lots traded and the current price.

I notice you mention it like this in your following post. So did you mention it here in error or what? Also, the title of this thread is conflicting with the discussion somewhat.

I think some of you are getting confused. Also note that in mql4 you can in fact get access a value that specifies how much a 1 lot trade is going to net you per pip which is more to what the thread is asking. C'mon man, it depends on the size of the trade. If I'm shorting cable with half a lot, at 3PM at some day, with a leverage of 200:1, value per pip could be x amount of my base currency, (we'll call it $26.7 AUD) I long the same pair, five days later but now with a standard lot and a leverage of 400:1, value per pip could be the same or it could be 36.1, or 17.1, who knows. I just don't get it why you think value per pip is some sort of a standard price that can be applied anywhere?

If I feel like I wanna long 0.38 lots of a pair, I don't. IgnoredSorry, you lost me with this post, but I'm wondering if we're just talking about two different things. Pip value, as opposed to position size (they're not the same things), remains fairly stable because exchange rates, most of the time, won't change much in 5 days (per your example). Yes, EURUSD 1.4200 moving to 1.4500 is 300 pips, but it's only 3 cents - not a significant change in the grand scheme of things. I think part of the confusion is where you refer to base currency as your account currency (you're in Australia, so your account is in Australia dollars). When I refer to base currency it's the second currency listed in the exchange rate.

USDCHF, the base currency is CHF; EURJPY, the base currency is JPY, regardless of which currency I have in my account. All of this has nothing to do with leverage or position size or time of day, it has everything to do with the exchange rate between your account currency and the base currency in the pair being traded.