Forex Margin Calculation Formula

- Posted in:Admin

- 29.10.18

- 62

Wells Fargo provides rates at its sole discretion. The foreign currency rate typically includes Wells Fargo’s sell or buy rate for that particular foreign currency, and/or a charge in order to compensate Wells Fargo for any number of considerations, such as risks taken, costs incurred and services rendered (i.e., “mark-up”), including the amount of revenue Wells Fargo expects to earn as a profit. No representation is made that Wells Fargo’s pricing is reflective of rate sources or publications, or rates being offered by other providers. Wells Fargo may offer different rates to different counterparties for the same or similar transactions. Central bank of kenya forex exchange rates.

- Forex Margin Calculator Software Free Download

- Margin Calculation Formula Excel

- Stock Margin Calculation Formula

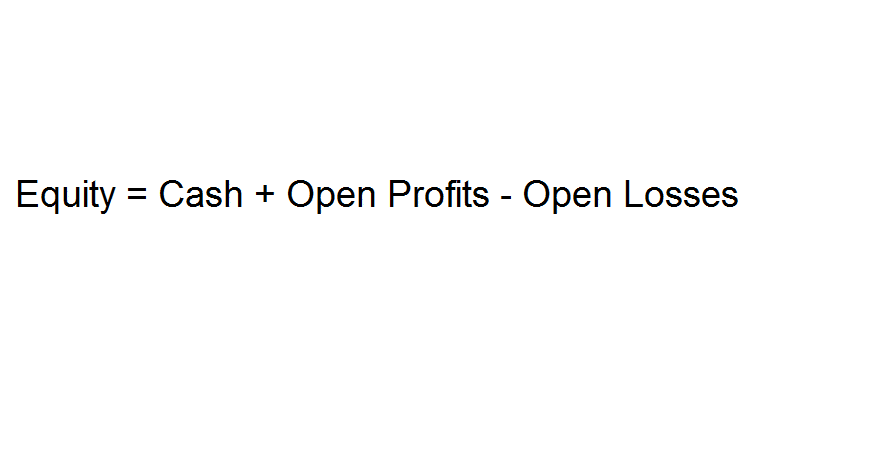

Let’s sat the leverage you use for your Forex trading is x30 or 1:30 then the margin requirement = (1.2900*10,000)÷30 = 430 U.S. Now let’s calculate the margin required if the same position is taken by a leverage of 50 then the Margin required = (1.2900*10,000)÷50 = USD 258. Attached is a Margin Call (Excel 2003) spreadsheet. To mathematicians & veteran traders, I need all the help to solve the equation to auto-calculate the pips needed to trigger margin call% I know different brokers have different Margin Call policies. Use our pip and margin calculator to aid with your decision-making while trading forex. Maximum leverage and available trade size varies by product. If you see a tool tip next to the leverage data, it is showing the max leverage for that product. Please contact client services for more information. Forex Margin Call & Closeout Calculator Get a rough estimate of the hypothetical exchange rate that would cause a margin closeout for a specific trade, and its corresponding loss. (This tool assumes there are no other open trades.). Use our pip and margin calculator to aid with your decision-making while trading forex. Maximum leverage and available trade size varies by product. If you see a tool tip next to the leverage data, it is showing the max leverage for that product.

Use the online margin calculator to find out the selling price, the cost or the margin percentage itself. Calculate any of the main variables in the sales process - cost of goods sold (how much you paid for the stuff that you sell), profit margin, revenue (how much you sell it for) and profit. In general, your profit margin determines how healthy your company is - with low margins you're dancing on thin ice and any change for the worse may result in big troubles.

High margins mean there's a lot of room for errors and bad luck. There are a few calculators that are similar in nature - please see (or ), or a very similar. You might find and convenient, too. • find out your COGS (cost of goods sold).

For example $30. • find our your revenue (how much you sell these goods for, for example $50). • calculate the gross profit by subtracting costs from revenue. $50 - $30 = $20 • divide gross profit by revenue: $20 / $50 = 0.4.

Forex Margin Calculator Software Free Download

• express it as percentages: 0.4 * 100 = 40%. • this is how you calculate profit margin. Or simply use our gross margin calculator! As you can see, margin is a simple, but in opposition to markup, it's based on revenue, not on Cost of Goods Sold (COGS). Gross margin formula The formula for gross margin percentage is as follows: gross_margin = 100 * profit / revenue (when expressed as a percentage). The profit equation is: profit = revenue - costs, so an alternative margin formula is: margin = 100 * (revenue - costs) / revenue.

Margin Calculation Formula Excel

Now that you know how to calculate profit margin, here's the formula for revenue: revenue = 100 * profit / margin. And finally, to calculate how much you can pay, given your margin and revenue (or profit), do: costs = revenue - margin * revenue / 100. A note on terminology All the terms (margin, profit margin, gross margin, gross profit margin) are a bit blurry and everyone uses them in a bit different context. For example, costs may or may not include expenses other than COGS - usually, they don't. I'll be using these terms interchangeably and forgive me if it's not in line with some definitions - what's important to us is what these terms mean to people and for this simple calculation the differences don't really matter. Luckily, it's likely that you know what you need and how to treat this data. This tool will work as gross margin calculator or a profit margin calculator.

Stock Margin Calculation Formula

So the difference is completely irrelevant for the purpose of our caluclations - it doesn't matter in this case if costs include marketing or transport. Most of the time people come here from Google after having searched for different keywords. In addition to those mentioned before, they searched for profit calculator, profit margin formula, how to calculate profit, gross profit calculator (or just gp calculator) and even sales margin formula. Margin vs markup The difference between gross margin and markup is small but important. Binary options. The former is a ratio of profit to the sale price and the latter is a ratio of profit to the purchase price (Cost of Goods Sold).