Breakout Strategy Binary Options

- Posted in:Admin

- 28.09.18

- 31

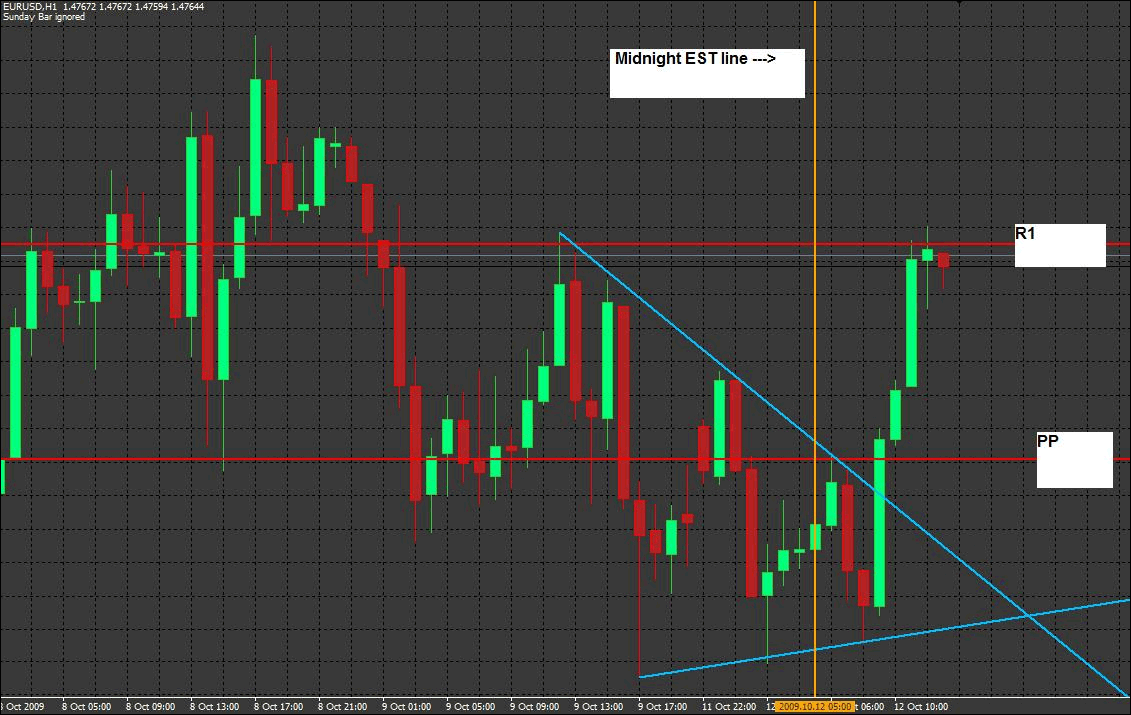

The online EUR/USD chart demonstrates the ratio of the two largest world economies, which, of course, are those of the Eurozone and the United States of America. The EUR/USD pair has increased liquidity and good volatility, which with a competent approach allows generating a high profit. Oil dollar forex chart. WHAT ELSE YOU NEED TO KNOW ABOUT THE EURO Dollar CHART? Many traders add the combination in question in their investment portfolio. In this process, you will be assisted by our EUR/USD exchange rate tracking tool.

Download the Box Breakout Ladder Binary Options Strategy About The Trading Indicator The Breakout-zones.ex4 indicator is a simple indicator which helps the trader detect areas where price action works within a range.

Binary Options Strategy

Binary Options Breakout Trades Using Pivot Points Binary options trading success is based on making the right calls on price direction. If a trader can correctly predict where price will go, then it is very likely he will make a trade that will be in the money. One of the ways this can be achieved is by being able to predict price breakouts.

This leads us to ask the question: what really is price action, and what determines the behaviour of price action at any given point in time? The concept of price action is simply a depiction of the activity of traders in a particular market. Traders are in the market to make money. If they see something that will present itself as a market opportunity, they will put their money in the market to make the trade.

At this time, we will see prices moving in one direction or in the opposite direction. If traders see nothing to convince them of an opportunity, they will sit on the fence and do nothing. At this time, the price action will hardly go anywhere except just trend sideways. Fortunately, the binary options market helps us to trade the price action, whatever that may be. Unlike in forex trading or other markets where you need the market to be in motion to make money, you can actually make money in the even if the prices of the underlying asset stay still. In today’s lesson, we will explain a scenario that occurs when the market is in motion; the breakout. Breakouts occur after periods of price inactivity.

The answer is that you can indeed make money in binary options trading. However, you will have to put an effort into it. As explained above, you will have to learn money management, reading of charts as well as the usage of indicators. For instance, trading gold, youtube commodity with an intra-day volatility of make to 10, pips in options of high volatility, requires trading capital in tens of thousands of dollars. With payouts for binary options trades are drastically reduced when the odds for that trade succeeding are very high. The key to binary options trading is to control risk. As a result, a trader can never lose too much money on any particular trade. Hypothetically, a trader has a 50% chance of being correct on any trade whether they buy a call or a put option. Binary options brokers will generally have their trading platform open when the market of the underlying asset is open. So if trading the NYSE, Nasdaq, DOW or S&P, the assets will be open to trade during the same hours as those markets are open. How to make money with binary options trading post.

They occur when traders get a hint of an impending market event that will affect the value of an underlying asset, so they take position in order to make money from such movements. One way of determining this is to look at the behaviour of the price action at the key levels of support and resistance. Before we get an upward break, prices may have tested the resistance level multiple times, with the points of retracement getting progressively higher. This indicates buying pressure. When we see this, this is a signal that prices will breakout upwards.

The reverse is also the case for downward breakouts. Support levels will be tested repeatedly with points of retracement getting progressively lower, signifying selling pressure. At other times, the buying or selling pressure may already be in such forceful effect, that the price action just rams through the key levels. Look at the chart below: The pivot points show the support and resistance levels. We can see that R1 has been tested several times, and prices do not get back to where they started for the day at S1 before going back up. This indicates buying pressure which eventually breached R1. Price then tested R2 several times, but retracements never get back to the central pivot (marked purple) which was the previous retracement point.