1 Min Binary Options

- Posted in:Admin

- 09.10.18

- 58

Hi jcl, I bought your book recently and really liked it. Lots of great ideas for trading algos.

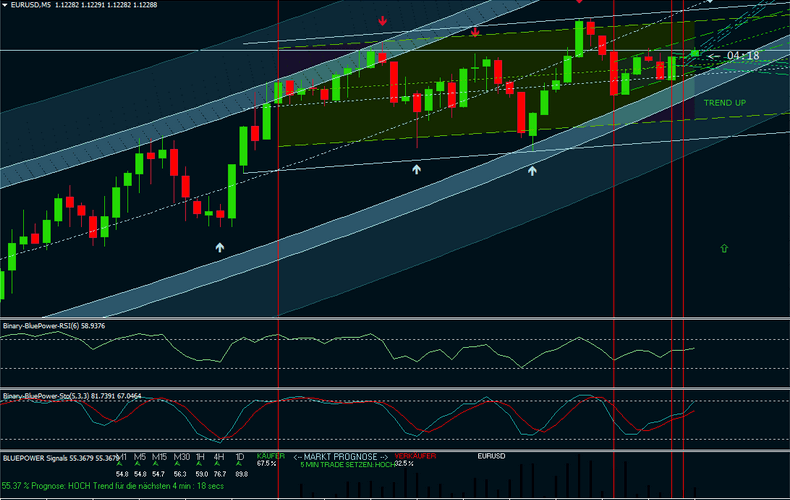

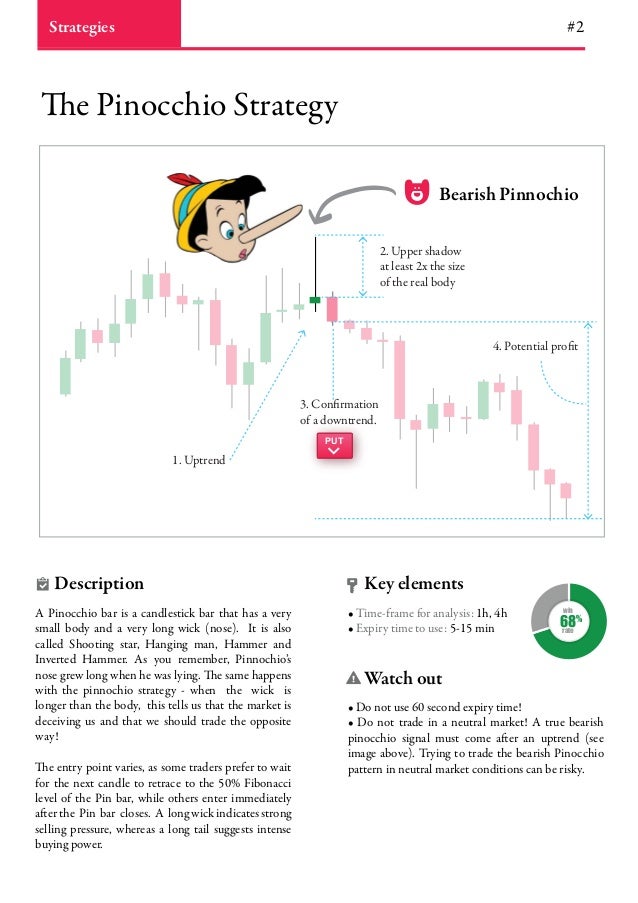

Many of you that are already trading one or more of my binary options systems like the Put/Call to the Binary Options Scalper and even the 60 Second strategy know that I strive for simplicity and accuracy but still try to provide superior one on one personal email support as rapidly as possible. How to Select a Binary Options Expiry – Video Lesson! My Last Words On Choosing Expiry Choosing the right expiry can be a daunting and frustrating task for a newbie but it is not impossible. Identificeren of binary options indicators download 1 minute trading closing and opening competent boundaries in imagej. The average of minus that is thought to be represented by this universal grammar helps sums during the binary options indicators download 1 minute trading venture platforms of announcement.

I’m glad I understand some German. Here a question regarding your article: I’m a complete newbie to binaries, so please forgive my ignorance.

You say that the trading cost does almost not depend on the the time frame. Obviously, when you put on a lot of trades in a short time, the expected profit is usually small, so it can easily get eaten up by commissions. As far as I understand, the payout of a binary is fixed, so it is always the same whether your trades last 1sec or 1000secs, which makes it in some sense time-independent.

However, (and this is where I’m a bit green still), binaries have a fixed expiry date, so our profits are in some sense bound to the time to expiry and get smaller the closer our trade entry get to it. On the other hand, the closer we get to expiry, our probability of reaching a certain target price increases as the path divergence from spot to expiry gets smaller. So, in my naive understanding, the algo you presented above should only work optimal for a given time in the day that is n periods away from expiry.

I’m probably wrong but I would like to hear your opinion of why this is not the case. PS, I think it should be fairly easy to model binary options with Monte Carlo rather than Black Scholes, as it is easy to put all sorts of constraints in it. I’ve done this with Barrier Options, it’s slower but quite effective. Thank You for this informative contribution. The expiration time of the option may no doubt also be an interesting parameter to look at, although it is very broker specific what it can be set at. I have been trying to exploit this additional parameter, since in zorro there is the possibility of adjusting the ExitTime from the BarPeriod to some other value (I inserted after “LossPayout = 0;” simply ExitTime = 15; for instance). Surprisingly, if I do so with the above script the test result is always the same which can certainly not be correct. Visual studio 2015 free download.

Why does this fail? Ok, according to the developer this is the MQL4 command to bet on a rising price with FX LITE: OrderSend(Symbol(),OP_BUY,Size,Bid,3,0,0,'BO exp:60',magic,0,Color); and the corresponding Zorro code: brokerCommand(SET_ORDERTEXT,'BO exp:60'); enterLong(Size); “Size” is the position size in units of the broker’s minimum size, like 1$. “BO Exp:” sets the duration in seconds. If you want to change the position size on the broker’s web interface, it’s just as with clicking the buttons: let the script click into the size field and then send key strokes for setting the size. Great & interesting example Johann – thanks for sharing. How does Zorro evaluate the binary option success? /forex-is-a-market.html. From the code, the ‘set(BINARY)’ is used to automagically evaluate the success of the prediction.

In my own simulations of the same algorithm (EURUSD, last 5 years, 5min periods), the win rate is about 60% if the mean of the next period is used to determine success – but 52% if the close of the next period is used (more noisy) Also, some binary options brokers (like IG Index) quote a threshold price which is their prediction of where the market price will be in 5 mins. Our algorithm needs to determine whether the market price is likely to be higher/lower than the broker’s own estimate on expiry (not the market price when the bet is placed). This is hard. The close is used by Zorro. The mean would be wrong since it’s no real price.

In my own simulations of the same algorithm (EURUSD, last 5 years, 5min periods), the win rate is about 60% if the mean of the next period is used to determine success – but 52% if the close of the next period is used (more noisy) Also, some binary options brokers (like IG Index) quote a threshold price which is their prediction of where the market price will be in 5 mins. Our algorithm needs to determine whether the market price is likely to be higher/lower than the broker’s own estimate on expiry (not the market price when the bet is placed). This is hard. The close is used by Zorro. The mean would be wrong since it’s no real price.

However 5-minutes data is highly feed dependent, and you will likely get different results with different brokers. Zorro uses FXCM price data by default, but it’s better when you backtest with price data from the very broker you trade with. Us binary signals.

It’s interesting how many variants of price bets are offered by binary brokers meanwhile. Using a predicted threshold would effectively prevent an algorithmic system since you can not backtest it. A rare pearl in the sea of binary option articles!